WHY DOES FORBES have so many scammers on its front cover? Why is the SEC investigating Binance when they failed to investigate this obvious Tingo situation scam listed on the NASDAQ?

Another major scammer has emerged from Nigeria like Hush Puppi he was verified by Instagram making him look more legitimate to unsuspecting investors. Of course he has already turned off comments on his instagram.

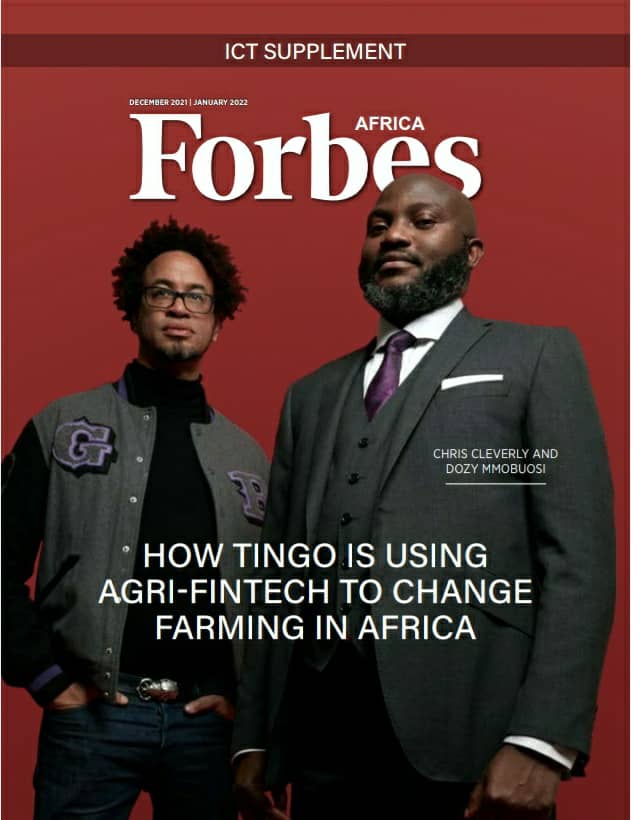

The stocks of Tingo owned by Dozy, a Nigerian-based agritech company, plunged by as much as 80.27 percent to close at $0.07 on Tuesday evening after Hindenburg Research released a report alleging fraud activities in the company.

Earlier this year 2023, Dozy was close to the acquisition of Sheffield United for around £90million LOL

It’s a tale that’s becoming all too common – a once prominent business leader is exposed as a fraudster. This time, it’s the turn of Dozy Mmobuosi, the founder of Tingo, a Nigerian agricultural technology company that promised to revolutionize the industry. But it seems that behind the slick marketing and promises of huge returns, there was nothing but smoke and mirrors.

Hindenburg Research, a company that specializes in exposing financial frauds, revealed that Tingo’s entire business was a scam. According to Hindenburg, Tingo had inflated its revenue and exaggerated its partnerships with other companies, leading investors to pour money into a business that was never going to deliver on its promises. As a result, the stock of Tingo, which was owned by Dozy, took a nosedive.

So who is Dozy Mmobuosi? Until recently, he was a highly respected figure in the Nigerian business community, with many lauding him as a visionary entrepreneur who was transforming the agriculture sector. He was believed to be worth 7 billion pounds – an astonishing sum that placed him among Nigeria’s wealthiest individuals. But now, it seems that his fortune was built on a foundation of lies.

The fallout from Hindenburg’s revelations has been swift. Tingo’s share price has collapsed, wiping out the investments of thousands of people who believed in the company. Many are calling for Dozy to be held accountable for his actions, with some even calling for him to be arrested.

We can of course blame the blinded westerners like Forbes and the SEC for failing to do their job and for being blinded by greed but what about the country that continues to churn out these larger than might fraudulent fly by night companies.

Nigeria is a conundrum the scammers have learnt from the leaders. The country has once again ushered in a dubious President who is factually accused of money laundering for drug dealers in the United States.

You go to Nigeria and you will be amazed at the obscene amount of wealth flying through the country in the face of obscene poverty.

The hard working citizens look on wondering how it is they work so hard with little results yet some of their comrades flaunt billions of Dollars in the same country.

Hindenburg mentions in their scathing report that Tingo’s reported cash in hand is probably non existent In our opinion given previous cases such as this it probably exists however in the private accounts of Dozy and more likely his girlfriends! Yes indeed this is the formula these Nigerian fly by night unexplained wealth types follow – they hide the money in young women’s account who have wig businesses and restaurants leaving the rest of the Nigerians wondering how the owner of a wig restaurant and a not so successful restaurant could possibly be flying around in private jets and taking expensive lavish holidays on the whim every two weeks to destinations as expensive as Monaco.

You’ll also see this fly by night Nigerian Billionaires throwing eye popping lavish events nearly every month making Nigerian event planners more wealthy than the average event planner in any other country. Usually the original wealth comes from drug trafficking or 419 scams, they then parlay the funds into more legitimate looking gibberish businesses such as Tingo farms to explain the unexplainable wealth.

Despite our scathing attack on Nigeria, the sad truth is that Dozy is far from alone in perpetrating this kind of fraud. Around the world, there are countless examples of business leaders who have misled investors in order to enrich themselves. And while it’s easy to blame the individuals concerned, it’s also clear that the systems that allowed them to get away with it need to be overhauled.

Ultimately, the story of Dozy Mmobuosi is a cautionary tale for anyone who is thinking of investing in the stock market. Even the most promising-sounding companies can turn out to be fraudulent, and it’s essential to do your due diligence before parting with your hard-earned cash. But beyond that, we need to ask ourselves why these scams keep happening. Until we tackle the root causes of financial fraud, stories like Dozy’s will keep repeating themselves.

Update Gaffe

You missed an opportunity if you shorted his stock with only 10000GBP when this post was published you would have made 120,000GBP by now! Lesson: Read unmasked every day and take action

Instagram @dozymmobuosi1

followers 96.9K

By The Sun