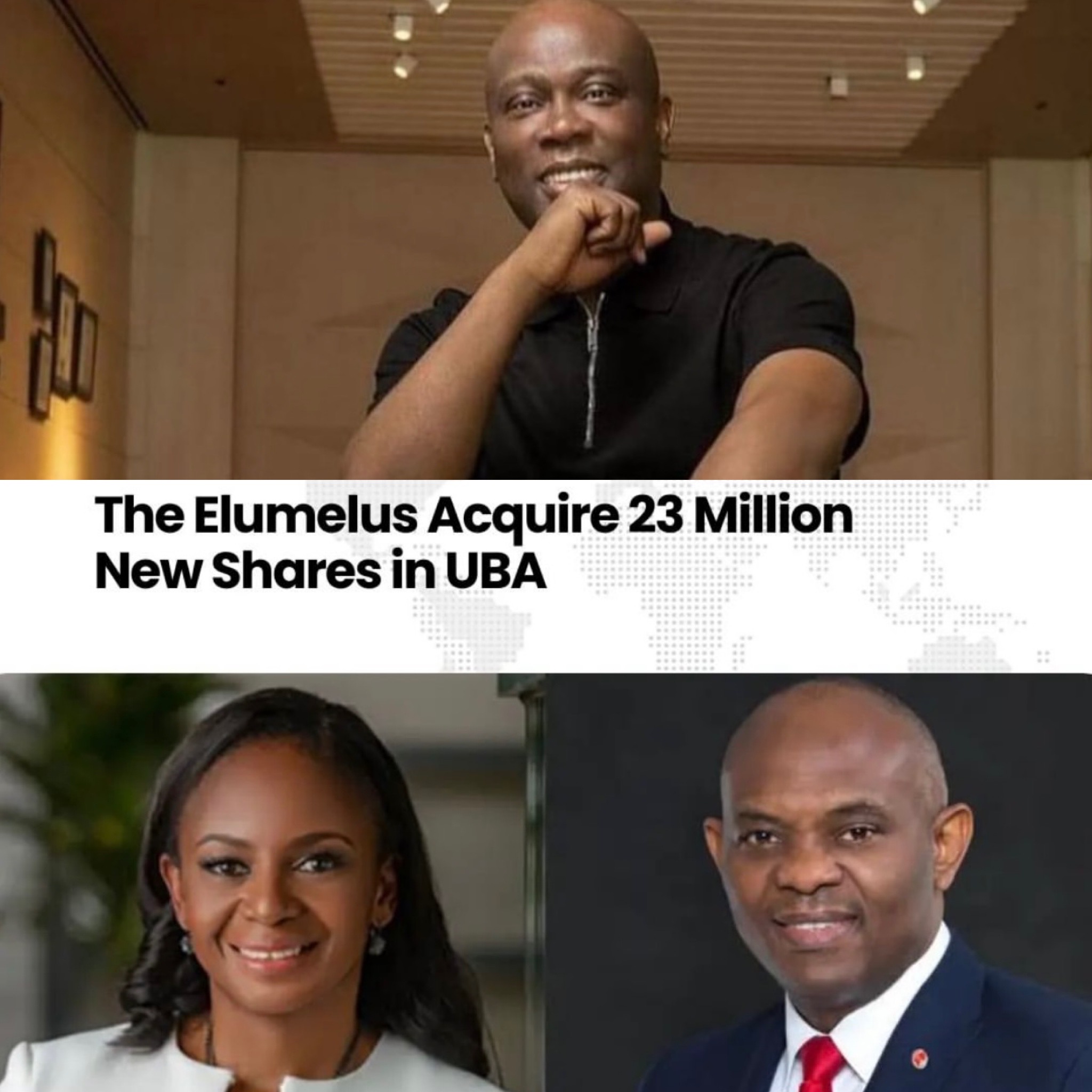

Greetings and salutations, my fellow Unmasked Slaylebrity tribe. Today, I come to you with a revelation that has sent shockwaves through the financial and political landscape of Nigeria. In recent days, former Deputy National Chairman of the People’s Democratic Party (PDP), Bode George, has made some explosive allegations about top billionaire bankers in Nigeria. These allegations include the late Herbert Wigwe, Tony Elumelu, and the former Central Bank Governor Emefiele.

Let us start with the late Herbert Wigwe, the former Group Managing Director and CEO of Access Bank. It has been reported that shortly before his death, Wigwe had moved into a lavish ten million-dollar mansion in Lagos and was in the process of building a university purportedly worth a staggering $500 million. The question that arises is, how did he amass such wealth seemingly out of nowhere? These are questions that demand answers.

Additionally, Tony Elumelu, the founder of the Tony Elumelu Foundation and former CEO of United Bank for Africa (UBA), has also come under scrutiny. Bode George has questioned the source of Elumelu’s wealth, particularly regarding his rise to owning one of the largest banks in Nigeria. It has been noted that Elumelu has shown no clear sign of how he amassed such a substantial amount of wealth. These are serious allegations that cannot be taken lightly.

Moreover, the former Central Bank Governor Emefiele has also been brought into the spotlight. The ongoing investigation by the EFCC into the dealings with former Lagos Governor Ambode has revealed some questionable road contracts awarded to a company craneburg construction purportedly owned by Herbert Wigwe. This company is also known to have built Herberts new $10 million mansion in Lagos so the link is not far fetched. It has been alleged that Ambode, who has been residing in London since his exit as Lagos governor, is being investigated over a $300 million road project deal awarded to a company with close ties to the former governor’s “bosom friend”, Herbert Wigwe. This is a matter of grave concern and must be thoroughly investigated.

The allegations are grave, and they strike at the heart of the integrity of the financial and political systems in Nigeria. The people deserve transparency and accountability, especially from those in positions of power and influence. We cannot turn a blind eye to apparent discrepancies and irregularities in the accumulation of wealth and the awarding of lucrative contracts. These are matters that demand immediate attention and swift action.

It is important to note that these are merely allegations at this stage, and we must allow the authorities to conduct a thorough investigation. However, the gravity of these allegations cannot be overstated, and it is crucial that the truth is brought to light. The people of Nigeria deserve to know that their financial institutions and political leaders are operating with the utmost integrity and honesty.

In the grand scheme of things, this is not just about the individuals named in these allegations; it is about the larger issue of accountability and transparency within Nigeria’s financial and political systems. The people have a right to know that their hard-earned money is being handled and managed with the utmost care and responsibility.

To wrap this up , these allegations made by Bode George have sparked a firestorm of controversy and speculation. Indeed it seems that these suddenly rich bankers are fronts for higher powers that be, perhaps when they fail to comply with instructions they eliminate them? As we speak Access bank has begun preparations for new CEO, hmmm Let’s see who they install. Wigwe’s travel pattern for the super bowl was well known it was a family tradition. The integrity of Nigeria’s financial and political systems is on the line, and it is incumbent upon the relevant authorities to conduct a thorough and impartial investigation. We must demand transparency and accountability from those in positions of power, and we cannot rest until the truth is revealed. The people of Nigeria deserve nothing less. Thank you for your time.

ANOTHER INSIDER RELEASE

“May Herbert’s soul rest in peace. I however look at the story of Access Bank from another prism based on my inside knowledge of what happened. The story of Access Bank can’t be complete without looking at it’s foundation. The money to buy Access Bank didn’t come from any investors but a loan of about N16B from Intercontinental Bank (IB) managed by Akingbola. It was Akingbola that gave them that break to buy Access. That money was never paid back. Sanusi (Aig’s school mate at KC)as the CBN gov declared IB insolvent and put it up for sale. It was offered to Aig and Access Bank for N50b. A bank that was many times the size of Access bank. A bank with 350 branches offered for such ridiculous sum. Check the records, no other bank has been so cheaply sold in Nigeria. Access Bank didn’t have the money but Evelyn Oputu of BOI who is Aig’s mother in-law gave them the loan to buy IB. They paid the funds, took over the bank and then refunded the loan the next day. It was the biggest scam in Nigeria banking history. Of course the N16B loan was never repaid. I want to be clear that this is not talking evil of the dead but setting the records straight. I do not hold the Access scam against Herbert personally but I can’t keep quiet when records are being misrepresented. Akingbola was literally destroyed. But all said and done, to what purpose is our rat race and wealth acquisition.

MORE INSIDIOUS DETAILS

The story of how greed held the banking sector in the jugular and how the rat race to become super stars billionaire bankers brought out the beast in our bankers can only be captured in 2 parts. I’ll attempt to relay them.

Treating one phase in isolation of the other would only present a dim reflection of the daylight robbery and ‘jaguda’ that have characterised the banking sector since the past 3 decades and up till date.

Majority of the banking executives of the twilight of the 90s down to the dawn of the millennium popularly christened yuppies (euphemism for smart crooks) were actually sharks; over ambitious desperadoes masquerading as professionals. They exhibited so much ruthlessness from the onset.

The banking licensing era was a bonanza period no doubt. The coming of the SFEM polluted the sector once dominated by decent, highly disciplined bankers like Chief Sam Asabia, Victor Odozi, Alh Otiti, Chief Dele Falegan, OlisaMbu, Mohd Kollere, Ibrahim Ayagi, Oladele Olashore, Joseph Sanusi, Prof Green Nwankwo, Umaru AbdulMuttalab (father of US bomber) S.O Ogundipe, Subomi Balogun etc.

At the time, banks complied strictly with CBN’s monetary and other prudential guidelines without prompt. Every sectors of the economy including agriculture (with UBA leading others in borrowing to farmers) benefitted tremendously from loan facilities as all banks complied strictly with sectoral lending regulations.

Infractions on lending to productive sectors including SMEs was an exception. Banking was good and bankers served the community excellently well.

And then, the yuppies invaded the scene and changed gradually the culture, nuance and character of the Nigerian banking sector. The stringent rules began to give way, impunity crept in and conservatism – the hallmark of banking- lost its allure to sheer bravado.

The first casualties were the many unsuspecting innocent business persons hoodwinked into putting their monies in the sector. Even though they had the honour and glory of being decorated as owners and chairmen at the time, majority were however totally untutored in banking. That was their greatest undoing.

The first casualties of the ugly, clanish fight in the banking sector were these many ‘naive’ businessmen investors. That many of them had faint clue in the art and science of banking did not help matter.

They were lured into the sector by the liberal policy of the time on bank ownership, (N3 million to set up a Merchant Bank and N5 million for a retail bank) and of course by these smart alecs in Broad Street suits. Many of these investors got manipulated and eventually eased out the banks they promoted and financed by these yuppies using the instrumentality of the market.

Save for few stubborn investors, majority lost their investment in the banks invariably. The yuppies soon came of age, manipulated the books and sent out the investors. It was those magical years of SFEM, FEM, AFEM and those confusing fx lexicons.

The yuppie bankers cunningly stripped investors of their prized possessions; bought them off their heritage – the banks. Many of today’s so-called banker billionaires were mere employees in the banks they now owned just yesterday. Curious?

They went into the banks, acquired muscles and turned against the real owners. How many Nigerians can still remember today that Access Bank was actually owned, promoted and founded by a Chief Farodoye? Yes, Chief Farodoye was a finance man as ex Finance Director in NICON. But he was not tutored in banking. The abracadabra of those forex heady days was only understood by the smart yuppies.

I’m not sure many of us would remember too that there used to be a Prophet Godwin Otubu (Baba Aladura) living around Pen cinema Agege at the time. He owned and promoted Zenith Merchant Bank. Jim Ovia and Godwin Emefiele were just one of the yuppie bankers that helped him in starting the bank. Otubu provided the funds. Today Jim who hitherto was of IMB (International Merchant Bank) on Victoria Island way back before joining ZENITH now parades himself as the owner.

The refusal of Chief Omisade to allow a certain Jimi Lawal to outwit him at Alpha Merchant Bank led to the collapse of the upwardly mobile Bank – one of the fastest growing at the time. Nasir El Rufai (ex Kaduna State Governor) was just an officer in charge of properties at the time in Alpha Merchant Bank where Macaulay Iyayi held court as the CEO. Of course there were other tough investors that fought the ‘smart’ ravaging bankers to a halt.

They simply refused to hand over their patrimonies to the rampaging hawks in suits on a platter of gold. Chief Samuel Adedoyin left his Idunmota ‘Karakata’ to start Industrial bank. Himself and his close friend Otunba Oyin Jolayemi (Daily Needs Industry) who floated Victory Merchant Bank almost got their fingers burnt. They represent few of those stubborn investors that refused to hand over their investment to the yuppies, even though their banks went under as a result.

Baba Olowo – Deji Adeleke fresh from America went into farming in Ede. The yuppie bankers of those times lured him away from farming and made him do Pacific Merchant Bank. His friend Aliko Dangote followed with his own bank. But for their shrewdness they would have lost their respective banks to smart bankers. However, the two banking outfits didnt survive the onslaught. Stubborn investors like these individuals made tactical withdrawals, recouped their investment and allowed the banks to go under rather than allowing themselves be outsmarted by the yuppies.

A certain Revd Fapohunda floated Crest Merchant Bank on a strategic location opposite Eko Holiday in on Victoria Island. Like Chief Farodoye, he was not also lucky. His bank did not survive the onslaught of the rampaging bankers. Erastus Akingbola pursued the man with a hostile bid, took it over and sent the venerable gentleman packing. Revd Fapohunda reportedly begged that he (Erastus) retain his daughter working in the bank after the take over. A plea Erastus declined.

Of course at this time Akingbola had ceased to be the sombre guy marketing the Chartered Institute of Secretaries to whoever that cared to listen on broad street of the late 80’s. Sure Banker (Late Subomi Balogun) had transformed him to a banker of note.Level changed seriously, so also sobriety took flight.

But for providence and smart thinking Oceanic Bank would never have survived. With first class brains like Goddy Oniko, Dr Abraham Nwankwo (who later became Director of the Debt Management Officer at the CBN) at the helm of affairs, the Ibrus wisely planted Cecilia – one of their own – who later became the CEO in the bank as its founding administrative officer.

The Ibrus were ahead of the yuppie bankers in the scheme of things. Not surprising therefore that the Ibru family maintained their stronghold on the bank until it collapsed. Oboden – Cecilia’s son was already in line to succeed her as helmsman of the bank at the time the bank was taken off by ‘market forces’.

More like the infightings among the Jacobins after they’ve successfully demolished the Girondes, the second phase of the ugly development in the banking sector witnessed the bankers now turning against themselves.

Having cunningly hijacked their various banks the stage was now set for infightings among themselves. Of course with 3 strong performing banks in his portfolio, Eratus Akingbola by the twilight of 90’s was undoubtedly the man to beat. The big elephant in the room. A sound professional by any standard, he became the man to see whenever the subject matter concerns bail out.

Baba Oloye’s Société Generale Bank was not seeing the best of time. Oloye’s scion – Bukola Saraki- those were the days before he dabbled into politics- approached Akingbola for a bailout fund. His request was declined for whatever reasons.

They both moved on but Junior Saraki never forgot as Société- the most visible of their family’s investment went down as a result of Akingbola’s refusal to help.

Fast forward to the new millennium, Saraki aside having acquired some political muscles equally had tremendous influence in the apex bank. Sanusi Lamido Sanusi was his classmate in Kings College. He remembered the refusal of Akingbola to help their family sustain their bank and approached Sanusi to help take Akingbola down.

Of course Sanusi did the yeoman job and Intercontinental Bank about one of the strongest banking institutions of the time was brought down mercilessly just for a small infraction which ordinarily would not have qualified for such sledge hammer.

In reality it was nemesis that played out to nail Erastus Akingbola at this time. He merely paid for the wickedness he exhibited years earlier when he greedily took over his friend’s Crest Merchant Bank rather than helping the bank to stay afloat.

Needless to say that Sanusi Lamido met his own waterloo as well in the hands of a Ganduje who stripped him off his inheritance as Emir of Kano. Nemesis never sleeps.

The many dubious acquisitions done in the name of mergers and acquisitions in the sector turned many to overnight billionaire bankers. It is not without the connivance of ‘authority thieves’ that authorised ‘authority stealing’. They were simply granted unfettered access into our commonwealth, plucked as much as they could, use same to purchase our assets and cleverly walked off with their loots.

Sad thing is that they still around, collecting accolades and national honours.

Seriously, they are fit for no where but gaol for their ignominious role in ruining the economy. They are bad advertisement for upcoming generations notwithstanding the amount of billions they’ve made for themselves at the expense of national growth.

@mrhousingnigeria The Group Chief Executive Officer, Access Holdings Plc, Herbert Wigwe, is feared dead. Wigwe was reported to have died following a helicopter crash in California near the Nevada border, United States of America, The Will reports. There are also reports that his wife and son were also onboard the ill-fated helicopter.

BANK EXECUTIVES’ CRIMINALITY AND DESTRUCTION OF THE NIGERIAN ECONOMY.

The banks, their Executives in connivance with other elites, destroyed this country.

If Nigeria is the cesspool of financial corruption, the banks, especially the top hierarchies, are the major criminals and culprits and check them all out. They are all billionaires as key facilitators of all the financial crimes and financial corruption of this nation

99% of Bank MDs and CEO are criminals, yes including whoever comes to your mind right now. Once you have access to a banking licence in Nigeria, you are an overnight billionare.

They are intelligent, driven, ambitious, and can get things done, but they are driven by wanton greed and take advantage of the rotten Nigerian system. I was a banker myself, and I know book cooking and what is called financial engineering; it’s all financial crime.

Let me tell you how all the bank MDs you know are billionaires; the banks are officially allowed to access the FX market at official price, and the parallel market is selling at N100-N300 spread most times.

They go to CBN and access $100million for instance that is supposed to be used to fund commercial transaction, they will fund say $10million, and over invoice, forge all manners of document to submit to CBN as having used the $100m and then access the $90m and sell at black market price. It is called arbitrage. So in one week, some few guys will go home with 90m X 200 = N180 billion.

The economy will be overheated by parallel market activities, Naira will keep falling, inflation will keep rising, and people will keep suffering.

While the bank MDs will find one church and be donating money, find some kids to fund their fees and all manners of penance. For every one kid they save, 100 die of hunger from hunger because of the economy they batter. For every one hospital they build,another 1000 people die of lack of access to healthcare.

FX Arbitrage and round tripping do not satisfy them. They will partner with petroleum product importers, CBN, and DPR during the subsidy regime. You will import 3,000MT of products, and they will forge it as 30,000.

The subsidy on the extra 27,000MT will be shared by all “stakeholders” in billions. Everyone goes home happy except the Nigerian people whose money os been stolen, FG will borrow money to fund the subsidy when 40-60% of the subsidy is actually subsidising the greed and criminality of a few. And the economy is destroyed.

This is the reason behind the controversy about the actual quantity of fuel consumed by Nigetians daily as against the amount being subsided.

It is these men and women that will still launder money for any interested person and take their cut. That’d why you see that the bank Executives and well connected elites are 5 & 6; it’s a symbiotic relationship.

That is why even when they resign or retire, they will yet float another bank or hang around the financial industry because it is a cash cow in a corrupt country where monies are stolen daily, the banks are the conduit and the major players are the Mafians.

Let’s not even talk about how they manipulate their financials and books to take advantage of the market and investors, how they forcefully and coercive acquire others.

Bank executives are all criminals, 99% of them. Quote me

The major attraction for floating banks are the corrupt and fraudulent transactions a bank owner can facilitate via the fx market and all sorts of dirty stuff and not the actual financial intermediation that banks are supposed to be doing

How many people here have bank credits or loans. I currently live and do business in the UK, everyday I get offered credit cards with thousands of pounds in them in fact I have two that was just sent to me because I made an enquiry, I don’t even use them.

The day I registered my company here, the next week, banks and financial institutions in the industry I operate were already offering me stuff because they are actually into banking and need to make a spread by lending.

They are properly regulated, and you go to jail if you distort the system

I don’t know how Nigeria will ever get better, honestly, because even those we look up to are all criminals. If you go to the churches and see how these bank executives participate and fund “God’s work” and how they are given special recognition because of what they do for God. And in their communities, towns and cities, the scholarships, etc.

But the guys are all corporate Yahoo boys who fleece a whole nation and cause untold hardship, untimely deaths, and destruction of an entire nation in exchange for the billions that fund their vanity.

God will judge

Instagram @herbertwigwe

followers 24.5K